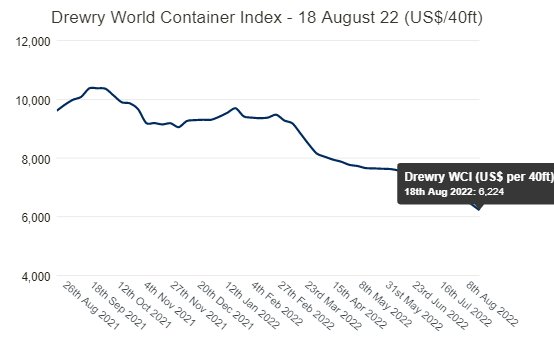

Drury's World Container Index (WCI) fell 3% to $223.82 per FEU6 for the week ended August 18, representing a 35% decline compared to the same week last year.

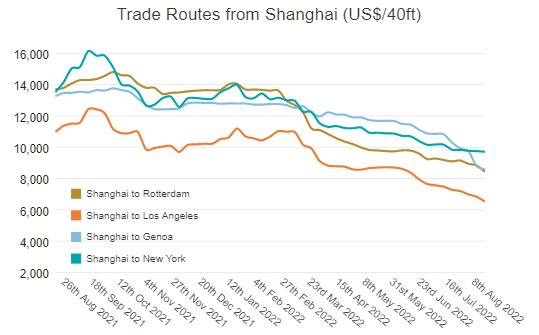

● Shanghai-Los Angeles and Shanghai-Rotterdam freight rates dropped 5% to $521 and $8,430 per FEU6, respectively.

● Shanghai-Genoa spot prices fell 2 percent, or $192, to $8,587 per 40-foot container.

● Rotterdam-Shanghai freight dropped 1% to $1,187 per 40-foot case.

● New York-Rotterdam freight rose 1 per cent to $298 per FEU1.

● Prices in Los Angeles-Shanghai, Shanghai-New York and Rotterdam-New York hovered around the previous week's levels.

Spot rates are a small part of most shipping companies' overall business and therefore have little direct impact, as seen in most shipping companies' Q2 results. One exception was ZIM Line, where lower spot freight rates resulted in lower average freight rates in the second quarter of 2022 than in the first quarter of this year. ZIM reported an average freight rate of $848 per TEU3 in the first quarter of 2022, but this figure dropped to $596 per TEU3 in the second quarter of 2022. The impact can be seen in ZIM's quarterly earnings, while second-quarter net income of $1.34 billion increased more than 50-fold.

Container lines derive most of their revenue from long-term contracts, which lag considerably behind spot freight rates because adjustments are made only when contracts are renegotiated. Although spot rates have begun to soften in recent negotiations, the agreed contract rates reflect unusually high spot rates in the following months and the impact of severe supply chain disruptions.

Indeed, shipping companies have been successful in locking more customers into long-term contracts, with Maersk's share of contracted long-haul traffic rising to 72% in the second quarter of 2022 from 70% previously. Lower spot rates will factor into the next round of contract rate negotiations, providing customers with more leverage, and shippers have had no choice but to accept the rates offered to them over the past two years.

The question is, how much further will spot rates fall, and at what level will they settle?

Current spot rates are still well above historical averages. Drury's WCI composite index may now be 40% below its peak of $377 per FEU10 reached in September 2021, but still 71% above its five-year average of $631 per FEU3.

While conditions at West Coast ports have improved, supply chain disruptions are far from over. Congestion is growing at U.S. East Coast ports, and a week-long strike is looming at Britain's largest port, Felicitstowe, following disruptions at other major European ports such as Hamburg. Some $800 million in trade is "at stake." Full normalisation of supply chains is still a long way off.

The combination of these factors, together with the fear of further black swan events, should provide a strong floor for spot rates, even if not at the lofty levels seen so far, to still be able to lock in significant contract rates in the next round of negotiations.