CMA announced last month that for one year from August 1, 2022, it would offer a reduction of €500 per container, equivalent to a discount of about 10 to 20 percent, for imported goods from large retailers in France, as well as all goods destined for French overseas territories. Shortly after announcing the offer, the company said it had decided to reduce freight rates for all imports from Asia to the mainland and French overseas territories to 750 euros per 40-foot container.

Maersk has made it clear that it will not follow CMA's approach that all customers in France will benefit from discounted freight rates.

Maersk says it believes in an open market economy and believes all its customers are important, regardless of industry or region. Therefore, discounts to selected customers based on the location of their headquarters are not considered. "With supply chains facing bottlenecks and global disruptions, helping our customers navigate these challenges is how we create value," he added. We are doing our best to keep our customers moving their goods by increasing capacity and expanding our products (services)."

Although CGM and maersk in helping customers through economic turbulence and the cost of living crisis took a different approach, but in the past 18 months, the two groups in the pursuit of the fast pace of strategic mutual set off, from major container shipping companies will each into an end-to-end logistics enterprises (that is, the integrator).

Maersk and CMA CGM are now forces to be reckoned with in air cargo and freight forwarding, thanks to acquisitions, substantial investments, and the latter's major partnership (with Air France-KLM).

CMA CGM is even more ambitious, having bought a roughly 3% stake in French satellite operator Eutelsat, according to Les Echos. The group this week also backed Eutelsat's bid for OneWeb, a UK communications company whose business plan focuses on building broadband satellite Internet services.

Transport conditions have not improved

Maersk's transatlantic service has been experiencing delays since the start of the year due to network outages in North America and northern Europe. These include port congestion, terminal congestion, reduced capacity and reduced onshore workforce capacity, which have led to bottlenecks and domino disruptions in global and local supply chains. This, in turn, lengthens waiting times and leads to the need to reschedule flights. Maersk said congestion at ports in North America and northern Europe was due to more ships than terminal capacity and limited yard space. Increased demand on other routes to terminals in North America and northern Europe has also put further strain on the network.

Shipping times from Asia have failed to improve despite a drop in demand in some regions, and according to a Taiwan-based freight forwarder, lower consumer spending is "dragging down" demand for sea and air freight, leading customers to believe shipping times will improve. However, they did not show signs of improving, because of gridlock not only at American ports but also inland truck and rail lines. Based on current experience, it takes about 25-35 days from loading to destination to pick up at port from Asian port, and more than 60 days from loading to final destination if the destination is inland, either west coast or east.

Maersk cited "broader demand weakness" in its July Asia-Pacific market update, adding: "The outlook remains highly uncertain and sees downside risks to the base scenario."

A recent survey of its long-term contract customer base by freight benchmark Xeneta found that many respondents were "looking to renegotiate contract rates in light of the recent decline in spot markets". Forty-four percent are no longer confident in the stability of long-term contracts - of that 44 percent, about 22 percent say they are more likely to allocate only lower volumes to cheaper contracts; 22% prefer to move to the spot market as soon as prices fall below long-term rates.

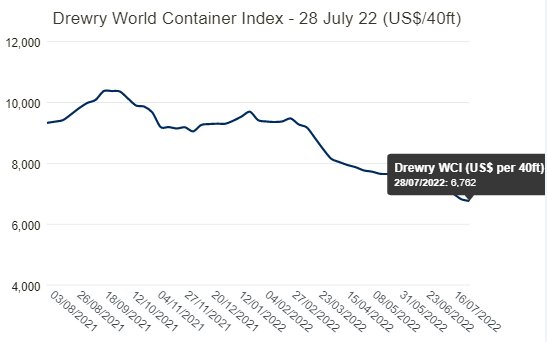

The world container index continued to fall

Drury's Composite World Container Index fell 0.9 percent this week to $6,761.63 per 40-foot container.